The worst of Australia’s property price correction may have passed, surprise new data shows

New data shows national home prices have fallen for the 10th month in a row, but there are signs the worst of the market correction may have passed.

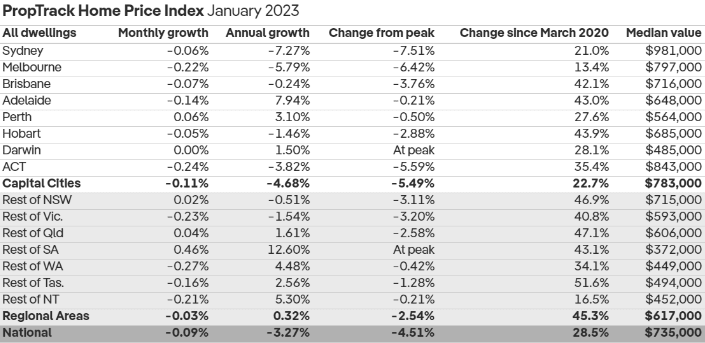

PropTrack’s latest Home Price Index for January has illustrated the continuing impact of rapidly rising interest rates on home values across the country.

According to the figures, home prices at a national level slid just 0.09% last month, now down 4.51% from their peak in March 2022.

“The Reserve Bank has pushed through a substantial 300 basis points of increases since May, which has weighed heavily on home prices in most parts of the country,” PropTrack senior economist and HPI author Eleanor Creagh said.

“A further hike of 25 basis points in February is widely expected, which will take the cash rate to 3.35%.”

The worst of the market correction may be over. Picture: Getty

While a continued reduction in borrowing capacities and an increase in repayment costs will have an impact on housing markets, Ms Creagh believes it will be to a lesser extent than previously seen.

“Looking at the latest data, the worst of the downturn appears to have passed,” she said.

“The rapid pace of price falls that we saw in June and July last year, as rates began to rise, has subsided. Price falls have eased in most capital cities in recent months.”

And despite several months of falls, home prices nationally remain a whopping 28.5% higher than they were pre-pandemic less than three years ago.

In January, prices were down in every capital city market except for Perth, which saw a modest increase of 0.06%, and Darwin, which held steady.

“Canberra and Melbourne saw the largest falls last month, down 0.24% and 0.22% respectively,” Ms Creagh said.

Home prices in Sydney, Brisbane and Hobart have now slipped from their respective peaks at the fastest pace in more than a decade, while Canberra also saw its quickest and deepest drop in more than 10 years.

“Sydney saw a 0.6% fall in January, with home prices now down 7.27% over the past 12 months,” Ms Creagh said.

“We’ve seen persistent falls since March in Sydney, although the magnitude of this market correction has eased in recent months from the faster pace of falls seen in June and July.”

The pace of home price falls in Sydney has eased in recent months. Picture: Getty

Melbourne home price falls also eased in January compared to previous months and are now 5.79% down year-on-year and 6.42% below the peak seen last March.

Conditions in Brisbane have shifted quickly on the back of rapidly rising interest rates and prices are now 3.76% below a peak recorded in April.

“However, the extent of price falls in the Queensland capital also looks to have eased in recent months,” Ms Creagh said.

In the nation’s capital, prices were down 0.24% in January and are now 5.59% lower than the peak seen in March 2022, although Ms Creagh said Canberra’s correction has also eased in recent months.

Adelaide, which has been the strongest performing capital city market in the past year, recorded a 0.14% reduction in prices in January.

However, they remain 7.94% higher than this time last year, with the comparative affordability of homes in the South Australian capital providing some insulation.

Home prices in Adelaide remain almost 8% higher than this time last year. Picture: Getty

Perth’s market is also holding up stronger against broader downward trends, with last month’s slight increase seeing prices remain 3.1% higher year-on-year.

Similarly, Darwin’s market is holding out at peak price levels, with values up 1.5% year-on-year.

In Hobart, prices slipped very marginally by 0.05% last month and are 2.88% below their April 2022 peak.

The city has recorded its fastest, but not deepest, decline from its peak in more than a decade, but the pace of price falls has slowed in recent months.

Broadly, Ms Creagh said home prices may begin to stabilise as RBA rate hikes pause later this year, as expected, bringing an end to uncertainty.